Allegro

Standing Strong With Chicago

President's Report

Volume 119, No. 5May, 2019

Photo by Walter Karling.

Adam Krauthamer

In mid-April, well over 150 Local 802 musicians stood together at Dante Park, directly across from Lincoln Center, to demonstrate solidarity with their colleagues on strike at the Chicago Symphony Orchestra. A group of 30 brass musicians from the Metropolitan Opera, the New York Philharmonic, and the New York City Ballet performed, conducted by Joseph Alessi, Principal Trombone of the New York Philharmonic. The Local 802 musicians in attendance spanned every genre from Broadway to classical to indie, and the musicians were joined by their fellow union members from Actors’ Equity, American Guild of Musical Artists, IATSE Local One, IATSE Local 764, the New York City Central Labor Council, AFL-CIO, SAG-AFTRA NY, and the Stage Directors and Choreographers Society.

Emma Gerstein, flutist at the Chicago Symphony Orchestra, spoke about the issues of the ongoing strike and thanked the crowd for the support. Metropolitan Opera clarinetist Jessica Phillips, New York Philharmonic violinist Fiona Simon, and New York City Ballet harpist Sara Cutler all spoke in support of their Chicago Symphony colleagues, and encouraged the crowd to donate to the Chicago Symphony strike fund at www.chicagosymphonymusicians.com. New York City Councilmember Helen Rosenthal (Manhattan, District 6) and a representative from the office of State Senator Brad Hoylman (Manhattan, District 27) also spoke in support of the striking musicians.

Chicago Symphony Orchestra musicians have been on strike since March 10 to protect their pension benefits and regain parity with other leading orchestras across the nation. Just like our own storied institutions housed at Lincoln Center, the Chicago Symphony has sizeable assets – in the CSO’s case, over half a billion dollars. They are enjoying ever-increasing ticket revenue and donations to the orchestra. Management is more than capable of managing its pension liabilities without shifting all the risk onto musicians.

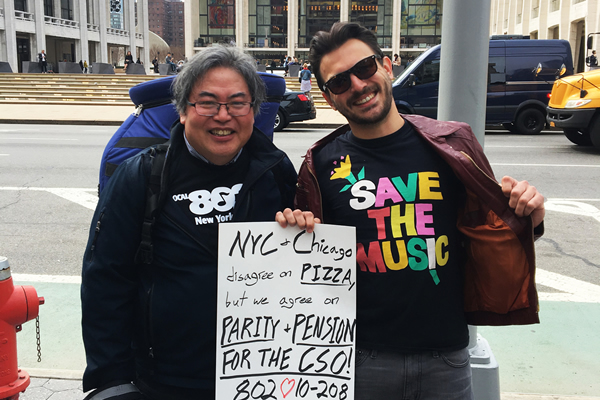

IN SOLIDARITY: Over 150 supporters came together to stand up for striking Chicago musicians. Photo: Walter Karling. See additional photos below.

Musicians across the country enrich the communities where we work, whether it’s in schools, concert halls, opera houses, clubs or bars, or on Broadway. All musicians ask for in return is a chance to make a fair living and a decent retirement. 802 will always organize behind these principles and make sure the public knows the valuable role musicians and the arts plays in society.

I want to thank everyone involved in the planning of the CSO rally and all the engaged supportive 802 members who showed up to voice their support for fellow musicians with one unified voice. We are organized and we are #802strong.

Update on Local 802 health plan

As the new lead union trustee for the 802 health plan, I was distressed to learn that the plan is not in good financial shape. I want to share this information with you and tell you what we plan to do about it.

The actuary for the health plan, Segal, recently informed the health trustees of the following:

- The health plan will lose $2.7 million for the 2018 fiscal year, which ended Sept. 30, 2018.

- On its current trajectory, the health plan will run out of money in December 2021.

- The current level of benefits is not sustainable absent contribution rate increases or benefit cutbacks.

This is unfortunately not a new story with the health plan. In the past 20 years, the health plan has been in financial trouble in 1999, 2001, 2006 and 2014. There have been at least four major rounds of benefit cuts in that 20-year period.

The basic problem we have is that the health plan has for too long been spending more money than it’s taken in. While medical and drug expenses have been going up every year by about 7 percent, employer contributions have not kept pace. As a result, in five of the past eight years, the health plan lost money.

To understand what’s happening today, we need to go back to 2014. In that year, due to new ACA regulations and financial shortfalls, the health plan trustees decided that over 1,000 plan B beneficiaries – then over 60 percent of the plan participants – would no longer receive any medical benefits whatsoever, only vision and dental. They also eventually eliminated the buy-up option for plan B participants to be able to access medical and hospital benefits. These changes saved the health plan millions of dollars, allowing the Broadway League and other employers to enjoy minimal contribution increases – or no increases at all – in the years following.

In the past 10 years, Broadway has increased its contributions to our health plan by under 2 percent. In that same time period – 2009 to 2018 – the health plan’s expenses increased over 77.4 percent. This way of functioning is simply unsustainable.

To save the health plan, we will need more employer contributions. That’s why we have asked the Broadway League for a substantial increase in employer contributions for our health plan. We plan to demand that all employers who contribute to the health plan also increase their contributions substantially. We are also asking that there be escalators in every contract to help keep pace with health inflation.

But increases in employer contributions will not be enough to right the ship. We are also taking a fresh look at benefits and how they are used in our plan. One area that will change is the usage of out-of-network providers by 802 plan participants. The bottom line is that too many of us are seeing out-of-network doctors even though out-of-network doctors cost the health plan far more than in-network doctors. Right now, only 77.5 percent of our claims are paid in-network, versus the norm of 90.9 percent for all other Aetna clients.

This doesn’t have to be the case. Aetna, which is our network, has very good doctors here in New York, which was one of the reasons the health fund made the switch from Magnacare to Aetna in 2017. We simply need to use the Aetna network more. To encourage in-network usage, deductibles for out-of-network doctors are going to increase. Plainly put, it will become more expensive for plan participants to go out of network for medical care. After careful consideration, the trustees decided that this was the fairest way to curtail costs. If you stay in-network you won’t see a cost increase, but if you leave the network, you will.

The one exception to this will be related to physical therapy, chiropractor and acupuncture services. Right now, there are no limits on visits. Unfortunately, that is going to have to change. While we realize that our population needs these services, we have to place limits on this coverage and are forced to follow the lead of our sister entertainment unions in capping them. In addition, we will work with Aetna on trying to get some of our most popular providers into the Aetna network.

You can expect more detailed announcements in the coming weeks about the new benefit design. By doing things a little differently, we think we can reduce our medical and drug costs by about $1.5 million per year. Taken together with a substantial increase in employer contributions, and appropriate escalators, we think we can put the health plan on the path to recovery. The good news is that we are reacting to the problems at the health fund as quickly as we can. However, it is an unfortunate reality that if the numbers still haven’t turned around in another year or two, we will be back in front of you to talk about more benefit changes. So we all need to do our part.

Just to note, our plan is 100 percent self-funded. What we and our employers pay in – plus investment income – is money available to all of us. Of course, we all realize there will be illnesses and injuries that require heavy usage by some. But we all need to work together to preserve the health of the plan, which means staying in-network as much as we possibly can. We think the Aetna network of providers can provide you all with excellent care.

Finally, what I can say for sure is that the path we are now on is unsustainable. When you pay out more than you take in, over many years, sooner or later something’s got to give. No health plan can stay healthy for very long if it constantly runs at a deficit. We need to be sure that the books are balanced at our health plan. That’s what we intend to do.

All photos below by Walter Karling, unless otherwise noted.

Photo by Lily Paulina