Allegro

A voice for our pension and health plans

Volume 123, No. 9October, 2023

On September 12, I attended the interim conference of the National Coordinating Committee of Multiemployer Plans. The NCCMP is the sole lobbyist that at the federal level advocates for Taft-Hartley benefit plans like Local 802’s health plan and the AFM’s pension plan. At this conference we got an update from Gordon Hartogensis, the director of the Pension Benefit Guaranty Corporation.

The PBGC pays pension benefits to retirees if their pension fund becomes insolvent. However, that guaranteed benefit falls far short of what most people would expect, capping out at a maximum $12,870 annually. A huge pension fund called Central States Teamsters (with almost 400,000 participants), was expected to become insolvent by 2024. Its insolvency would have made the PBGC itself insolvent by 2026. When that happened, any pension funds turning to the PBGC, (including the AFM pension fund), would have received far lower benefits — think more like $600 annually.

The American Rescue Plan Act (ARPA), signed into law by President Biden on March 11, 2021, now offers enough financial relief to troubled plans for them to continue to pay full benefits for decades as they work to address their sustainability into the future. This removed Central States and other teetering pension funds from their dependence on the PBGC. The PBGC’s assets are slowly growing as pension funds apply for the relief which is still processed and managed by the PBGC. The relief money is a stream of funding from the Treasury Department. There is no cap on it.

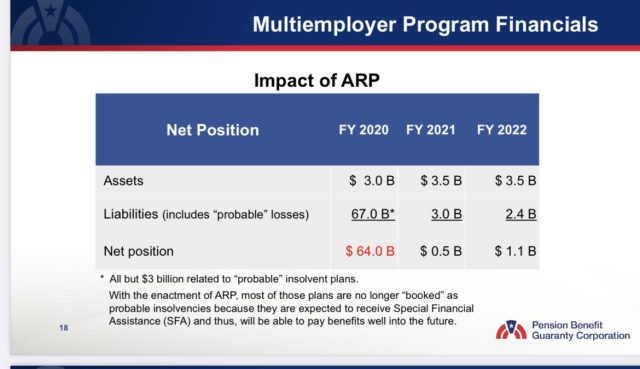

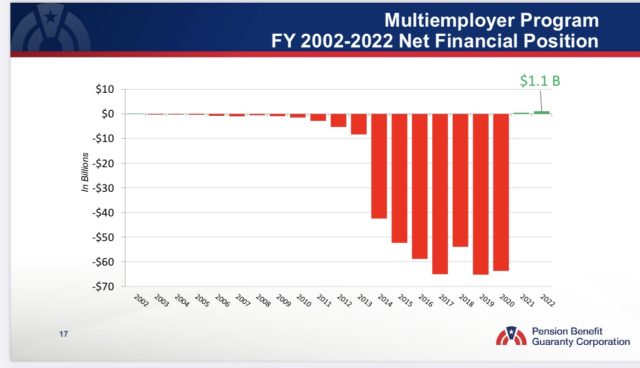

- In 2020 the PBGC was $64 billion underfunded with projected insolvency by 2026

- In 2020 the PBGC had $3 billion in assets and $67 billion in liabilities based on expected pension fund insolvencies, including the massive Central States Teamsters fund.

- By 2022 the PBGC was funded just over 100 percent by $1.1 billion

- By 2022 the PBGC had $3.5 billion in assets but a huge drop in liabilities — $2.4 billion.

The PBGC has approved 98 applications which represent $53.4 billion in relief on behalf of 766,940 participants. About $30 billion of that relief went to Central States. Twenty-two applications are under review, representing requested relief of $6.3 billion on behalf of 353,478 participants. The AFM pension fund is among those under review.

As participants in the AFM pension were informed in a letter dated August 7, our pension fund submitted its application on March 10 and withdrew it on June 30 to address some technical issues at the request of the PBGC and to update some of the projected data. The application was resubmitted on August 4. Our fund is expecting $1.44 billion in relief plus interest from December 31, 2022.

Martha Hyde is a member of the Local 802 Executive Board, and she also serves as a trustee both on the AFM pension fund and the Local 802 health fund. Read her series on the history of the pension fund in Allegro here.